The Electrical Contractor's Challenge:

Protecting Your

Most Valuable Assets

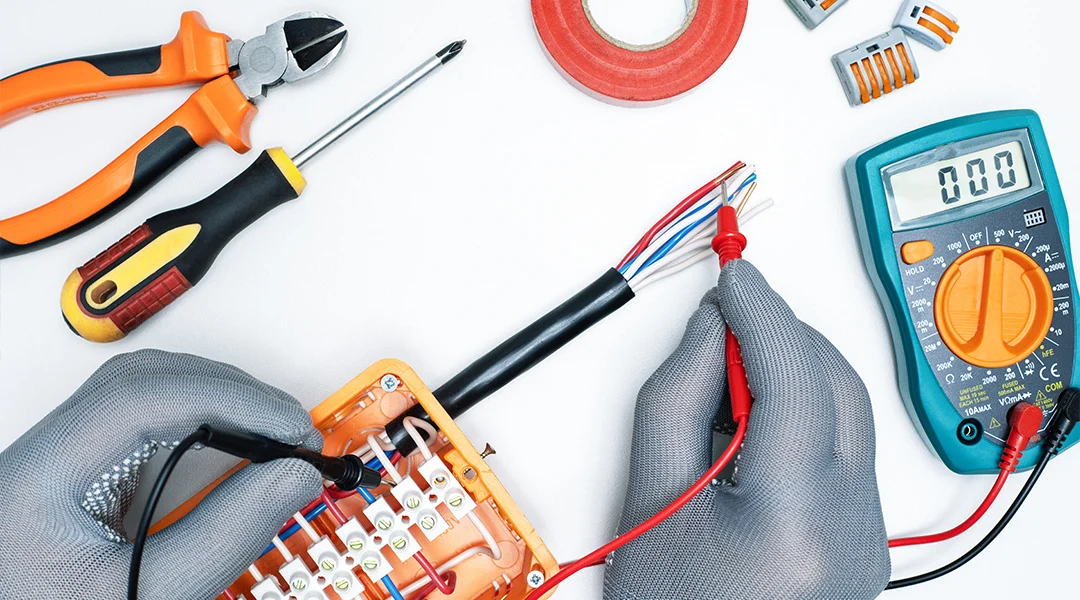

For electrical contractors in Plano, TX, tools and equipment are the lifeblood of your business. Each piece, from precision multimeters to heavy-duty wire pullers, represents a significant investment crucial for quality work. Imagine discovering stolen testing equipment from your truck or a thunderstorm damaging your generator. These aren't minor inconveniences; they're direct threats leading to costly delays, lost income, and damaged client relationships. The fear of theft, damage, or loss weighs heavily.

Tools and Equipment Insurance (Inland Marine) addresses this core challenge, providing a crucial safety net for your most valuable assets.

What is Tools and Equipment Insurance (Inland Marine)?

Tools and Equipment Insurance, also known as Inland Marine Insurance, is specialized property insurance protecting your movable tools, equipment, and machinery wherever they are. Unlike standard commercial property insurance, which covers assets only at a fixed location, Inland Marine covers items transported to job sites, stored off-site, or in transit.

For electrical contractors in Plano, TX, this distinction is crucial, as your work involves constant movement. This policy is essential due to the inherent risks of mobile operations. Tools in your vehicle, at a client's property, or temporarily stored are vulnerable.

Without this coverage, a stolen conduit bender or damaged voltage tester could lead to significant expenses, delays, and profitability loss. Inland Marine Insurance ensures quick recovery from setbacks, minimizing downtime and protecting your ability to serve Plano effectively.

What Does Tools and Equipment Insurance Cover for Plano Electrical Contractors?

For electrical contractors in Plano, TX, a robust Tools and Equipment Insurance policy offers comprehensive protection against various risks that could jeopardize your valuable assets. Tailored to the dynamic nature of your work, it ensures your essential gear is protected whether on a job site, in transit, or stored securely. Here’s a detailed look at what’s typically covered:

Theft

Coverage extends to tools and equipment stolen from job sites, your work vehicle (even if locked), or off-site storage facilities. For instance, if your expensive thermal imaging camera is swiped from a new construction site in West Plano, your policy can help cover its replacement cost.

Damage

Protection against a wide array of damaging events, including fire, vandalism, accidents (like dropping a tool), and natural disasters. Given Plano’s susceptibility to severe weather, this is particularly vital. If a hailstorm damages your portable generator at a project near Legacy West, or a fire breaks out in your workshop in East Plano, your insurance can cover the repair or replacement.

Loss

This includes situations where equipment is mysteriously misplaced or lost, making it impossible to locate. While proving theft can sometimes be challenging, a comprehensive policy may offer broader protection for unexplained disappearances.

Specific Electrical Tools and Equipment

The policy is designed to cover the specialized items critical to your trade. This includes, but is not limited to: hand tools (pliers, wire strippers, screwdrivers), power tools (drills, saws, impact drivers), testing and diagnostic equipment (multimeters, voltage testers, thermal imagers), conduit benders and threaders, wire pullers and fish tapes, ladders and scaffolding, generators and air compressors, heavy equipment (scissor lifts, trenchers), and portable office equipment (laptops, tablets).

Rented or Leased Equipment

Many policies can be extended to cover equipment you rent or lease for specific projects, protecting you from liability for damage or loss to items you don’t own but are responsible for. This is particularly useful for specialized equipment that you might only need occasionally.

Peace of Mind for Plano Electrical Contractors

By understanding these coverage aspects, Plano electrical contractors can ensure their most critical assets are protected, allowing them to focus on delivering safe and efficient electrical solutions without the constant worry of financial setbacks due to unforeseen events.

Pro Tip: Review your Inland Marine policy annually. As your business grows and you add more tools or vehicles, updating coverage ensures you’re always protected at full value.

Understanding Tools and Equipment Insurance Costs in Plano

The cost of Tools and Equipment Insurance (Inland Marine) for electrical contractors in Plano, TX, varies. Premiums depend on factors reflecting each business's unique risks and operational profile. Understanding these helps you make informed decisions for competitive pricing. Key determinants include:

- Total Value of Equipment: Higher equipment value means higher premiums. Maintain an accurate, up-to-date inventory with current replacement values.

- Type of Equipment: More valuable or theft-prone tools (e.g., specialized testing equipment, heavy machinery) increase costs more than basic hand tools.

- Claims History: Frequent claims increase premiums, indicating higher risk. Good safety and security practices help maintain a clean claims history.

- Security Measures: Precautions like locked vehicles, secure workshops, job site containers, alarm systems, or GPS tracking significantly impact premiums.

- Location of Operations: Your primary business location and typical work areas within Plano influence rates. Higher crime rates or greater natural disaster exposure (e.g., severe weather) can adjust premiums.

- Deductible: The out-of-pocket amount before coverage begins. A higher deductible typically lowers premiums but increases initial expense during a claim.

- Coverage Limits: The maximum payout per item, occurrence, or policy period directly affects premiums. Higher limits offer more protection but cost more.

Transparent Pricing by Business Size

While exact figures require a personalized quote, here’s a general understanding of how costs might vary for Plano electrical contractors:

| Business Size | Typical Equipment Value Range | Estimated Annual Premium |

|---|---|---|

| Small Contractor (1–2 electricians) | $10,000 – $50,000 | $300 – $800 |

| Medium Contractor (3–10 electricians) | $50,001 – $250,000 | $801 – $2,500 |

| Large Contractor (10+ electricians) | $250,001 – $1,000,000+ | $2,501 – $8,000+ |

Note: These are estimated ranges and can vary significantly based on the specific factors mentioned above, as well as the insurer and policy specifics. Always get a customized quote for accurate pricing.

Importance of Accurate Valuation

Underinsuring equipment is a common mistake leading to significant financial hardship. Regularly update your inventory to reflect current replacement costs, not depreciated value, ensuring full protection.

Ready for a precise understanding of your insurance costs?

How to Get Tools and Equipment Insurance in Plano: A 3-Step Process

Securing the right Tools and Equipment Insurance (Inland Marine) for your electrical contracting business in Plano, TX, is straightforward with Neill Insurance. We've streamlined the process into three simple steps to ensure comprehensive protection with ease and confidence.

Step 1: Assess Your Needs and Inventory Your Equipment

First, understand what needs protection. Conduct a thorough assessment of all tools and equipment, creating a detailed inventory that includes:

- Item Description: Name of tool/equipment (e.g., Fluke 87V Multimeter).

- Make and Model: Specific manufacturer and model number.

- Serial Number: Important for theft identification.

- Purchase Date and Cost: Establishes ownership and value.

- Current Replacement Cost: Research replacement cost for adequate coverage.

Include smaller hand tool sets and larger equipment like generators or specialized testing devices. This comprehensive list forms the foundation for an accurate insurance proposal.

Step 2: Get a Personalized Quote from Neill Insurance

With your inventory ready, contact Neill Insurance. As local experts in contractor insurance for Plano, TX, we understand your electrical business's unique risks. You can:

- Call Us: Speak with experienced agents for guidance.

- Visit Our Office: For face-to-face consultation, our Plano office is ready.

- Request an Online Quote: Submit information via our website for a customized proposal.

We review your inventory, discuss operational specifics (e.g., equipment transport frequency, security), and help determine appropriate coverage limits and deductibles. Our goal is a tailored solution fitting your needs and budget.

Step 3: Review, Understand, and Secure Your Policy

After receiving your quote, thoroughly review the proposal. Our agents will explain all policy aspects, including:

- Coverage Details: Perils covered and items included.

- Exclusions: What is not covered.

- Limits and Deductibles: Maximum payouts and out-of-pocket responsibilities.

- Premium: Policy cost.

Ask any questions for complete understanding. Once satisfied, activate coverage. With Tools and Equipment Insurance, your Plano electrical contracting business is protected, allowing confident project focus.

Common Mistakes Plano Electrical Contractors Make with Equipment Insurance

Even with the best intentions, electrical contractors in Plano, TX, can inadvertently make mistakes regarding their Tools and Equipment Insurance, leaving them vulnerable. Avoiding these common pitfalls is crucial for comprehensive protection and financial security.

Underinsuring Equipment

This is perhaps the most significant mistake. Many contractors under-estimate the value of their tools, often forgetting to account for inflation, new acquisitions, or true replacement cost. Insuring for replacement cost and keeping inventory updated is crucial to avoid significant out-of-pocket expenses after a total loss.

Not Updating Inventory Regularly

Your business is dynamic; tools are acquired, retired, or upgraded. Failing to update your insurer means your policy may not cover newly purchased items or may over-insure retired ones. A yearly inventory review with your agent is a simple yet effective solution.

Assuming Other Policies Cover Tools

A common misconception is that General Liability or Commercial Property insurance adequately covers mobile tools and equipment. While essential, these policies typically have severe limitations for tools off-premises or in transit. Inland Marine Insurance is specifically designed to fill this gap.

Ignoring Security Measures

Insurance provides financial protection, but it doesn't replace proactive security. Failing to implement basic measures—like locking vehicles, using GPS trackers, or securing your workshop—increases theft risk and can impact premiums or claim validity if gross negligence is proven.

Not Understanding Policy Exclusions

Every insurance policy has exclusions. Neglecting to read and understand these can lead to unpleasant surprises during a claim. Damage due to wear and tear or intentional acts is typically excluded. Always clarify exclusions with your agent.

Choosing Actual Cash Value (ACV) Over Replacement Cost

While ACV policies have lower premiums, they pay out the depreciated value of your equipment. For constantly used tools, this can mean a significantly lower payout than needed for a new replacement, forcing you to cover the difference.

By being aware of these common mistakes and taking proactive steps to avoid them, Plano electrical contractors can ensure their Tools and Equipment Insurance provides the robust and reliable protection their business deserves.

Frequently Asked Questions About Tools and Equipment Insurance

Yes, many policies can be extended to cover rented or leased equipment. It's crucial to specify this need to your insurer, as you are typically responsible for damage or loss to equipment you rent. This ensures you're protected from liability for items you don't own but use for your projects.

The primary difference lies in mobility. Commercial Property Insurance covers your business property at a fixed location (e.g., your office or workshop). Inland Marine Insurance, on the other hand, covers your movable property ‒ tools, equipment, and materials ‒ while it's in transit, at various job sites, or stored off-premises. For electrical contractors whose equipment is constantly moving, Inland Marine is essential.

Claim processing times can vary depending on the complexity of the claim, the documentation provided, and the insurer. At Neill Insurance, we pride ourselves on efficient and responsive claims support, working diligently to help our Plano electrical contractors get back to work as quickly as possible. Providing thorough documentation (police reports for theft, photos for damage, detailed inventory) can significantly expedite the process.

For most smaller, lower-value hand tools, you typically don't need to list each one individually. These are often covered under a blanket limit. However, for high-value items (e.g., over $1,000–$2,500, depending on the policy), it is highly recommended to schedule them individually. Scheduling ensures they are covered for their full replacement value, preventing underinsurance.

Yes, a key benefit of Tools and Equipment Insurance (Inland Marine) is that it covers theft from your vehicle, even if it's parked overnight or at a job site. However, most policies require that the vehicle was locked and that there are visible signs of forced entry. Always ensure your vehicle is secured when storing tools.

It's crucial to inform your insurance agent promptly when you acquire new, valuable equipment. Many policies offer a grace period or automatic coverage for newly acquired property up to a certain limit, but it's always best to have it officially added to your policy to ensure full protection and avoid any gaps in coverage.

While Tools and Equipment Insurance (Inland Marine) is not legally mandated by the City of Plano or the State of Texas, it is highly recommended. For electrical contractors, whose business relies heavily on expensive, portable tools, it's a critical component of a robust risk management strategy. Many clients or general contractors may also require you to carry such coverage as part of their contract terms.

Several factors can help reduce your premium: choosing a higher deductible, implementing strong security measures (e.g., GPS trackers, secure storage, alarm systems), maintaining a clean claims history, and accurately valuing your equipment (avoiding over-insurance). Discuss these options with your Neill Insurance agent to find the best balance between cost and coverage.

Why Choose Neill Insurance for Your Commercial Auto Needs

For electrical contractors in Plano, TX, Neill Insurance is a dedicated partner offering tailored commercial auto insurance solutions. Here's why you should choose us:

Local Expertise, Global Standards

Deeply rooted in Plano, we understand local driving conditions and regulations, combining this insight with national best practices for personalized, robust coverage.

Specialized Understanding of Electrical Contractor Risks

We possess in-depth knowledge of your industry, recognizing that your work vehicles and valuable equipment are integral to your livelihood. Our policies reflect this understanding.

Tailored Policies, Not One-Size-Fits-All

We meticulously assess your fleet, drivers, and operations to craft policies that precisely fit your needs, ensuring critical protections without unnecessary coverages.

Transparent and Competitive Rates

We secure competitive rates from top-rated carriers, ensuring clear communication and fair pricing without compromising essential coverage.

Dedicated Support and Seamless Claims Assistance

We provide quick, empathetic support throughout the claims process, advocating for you to minimize business disruption.

Proactive Risk Management Guidance

We offer insights into driver safety, fleet maintenance, and Texas regulatory compliance, helping you mitigate risks and potentially reduce future insurance costs.

Choosing Neill Insurance means partnering with someone invested in your success. We empower Plano electrical contractors to drive with confidence, knowing their mobile operations are backed by comprehensive, reliable commercial auto insurance.

Our Track Record

0%

Client Retention Rate – Our electrical contractor clients stay with us year after year because we deliver on our promises.

0%

Average Savings – Our clients save an average of 20–25% on their insurance compared to their previous policies.

0+ Years

Serving North Texas Contractors – We've been helping contractors in Plano and across North Texas for over a decade.

Ready to Protect Your Electrical Contracting Business in Plano?

You've built a successful electrical contracting business in Plano. You've invested time, money, and hard work into creating something valuable. Don't let one lawsuit, one accident, or one uninsured loss destroy everything you've built.

The right insurance protects your business, your family, and your future.

At Neill Insurance, we make it simple. We shop 20+ carriers, find you the best coverage at the best price, and issue certificates in 1–2 hours so you never lose a job.

Get Your Free Quote Today

Three ways to get started:

What Happens Next?

- Step 1: You provide basic information about your electrical contracting business (5 minutes)

- Step 2: We shop 20+ carriers and compare quotes (we do the work)

- Step 3: We present you with 2–3 top options with clear explanations (you choose)

- Step 4: We handle the paperwork and issue your certificates in 1–2 hours (you get back to work)

No pressure. No obligation. Just honest advice and competitive quotes.