Could a single icy commute on I-35 leave you with a bill large enough to erase a lifetime of savings? For one Roanoke professional, it almost did.

This isn’t a hypothetical scenario. It’s a real-world case study of how a routine drive on a North Texas highway turned into a half-million-dollar nightmare. You’ll see exactly how a multi-car pileup unfolds financially, what your state-minimum insurance really covers, and how one driver’s decision to invest an extra dollar a day saved him from financial ruin.

If you commute on I-35 or anywhere in the Dallas-Fort Worth Metroplex, this is a must-read. We’ll break down:

•The Anatomy of a Six-Figure Pileup: A real-life look at how quickly damages stack up.

•The Hidden Gaps in Texas Minimum Coverage: What your 30/60/25 policy doesn’t cover.

•The $400 Decision That Prevented Disaster: How a small investment shielded a family from a $486,000 personal liability.

•A Clear Plan to Protect Your Assets: Actionable steps to ensure your family and finances are secure.

Prepared for What You Can’t Predict

Michael Richardson, a 42-year-old financial advisor from Roanoke, Texas, understood risk better than most. His daily 45-mile commute down I-35 to Dallas was a calculated one. He knew that the high speeds, heavy traffic, and unpredictable North Texas weather created a perfect storm for potential disaster.

That’s why, three years ago, he sat down with Sarah Martinez at Neill Insurance. He wasn’t just looking to meet the legal minimum; he was looking to build a financial firewall. Sarah, understanding Michael’s assets and the specific dangers of his commute, recommended a 250/500/100 liability policy. It was a significant step up from the state-mandated 30/60/25, but it was a decision based on a clear-eyed assessment of the risks.

The Hidden Hazard on I-35

On February 15, 2024, that risk became a reality. A sudden ice storm, a common threat in North Texas winters, coated I-35 in a treacherous layer of black ice. Near the Corinth Parkway exit, despite driving cautiously at 45 mph, Michael’s sedan lost traction. The vehicle spun, struck the median, and was thrown back into the northbound lanes.

The chaos that followed was swift and devastating:

•A 6-vehicle chain-reaction collision

•Two vehicles declared total losses

•Multiple occupants with serious, life-altering injuries

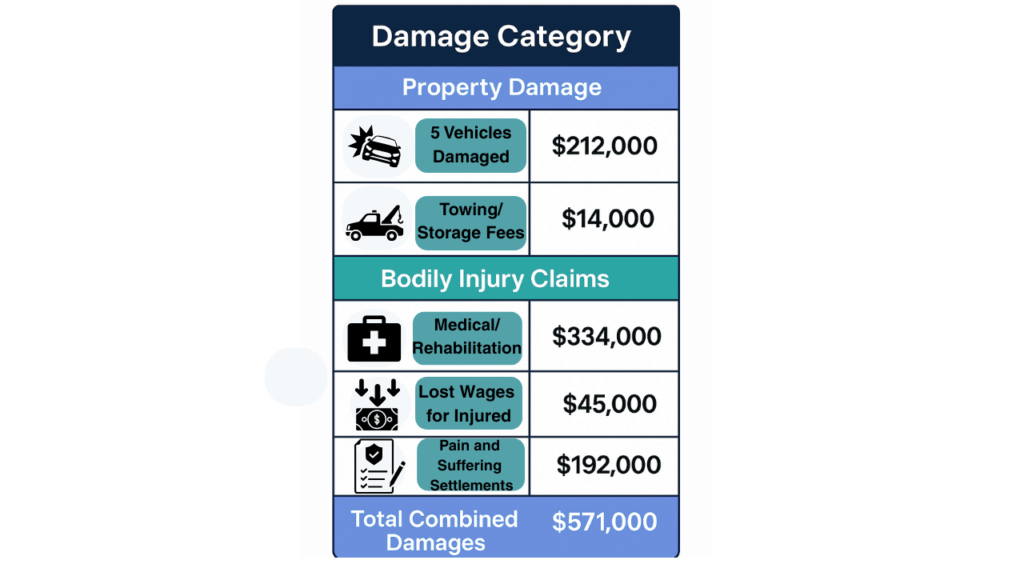

Under Texas law, because his vehicle initiated the chain reaction, Michael was deemed at-fault. The weather was a factor, but the legal liability was his alone. The total estimated damages quickly climbed to a staggering $571,000.

The $500,000 Lesson

Here is how the costs broke down, demonstrating just how quickly a single incident can spiral into financial catastrophe:

If Michael had carried only the Texas state minimum 30/60/25 policy, his coverage would have been capped at:

•$60,000 for all bodily injuries in the accident.

•$25,000 for all property damage.

His total protection would have been just $85,000. This would have left him personally responsible for the remaining $486,000. A bill of that magnitude would mean financial ruin—the loss of his home, savings, and future earnings.

The Path Forward

Michael’s story is a powerful lesson, but it’s also a blueprint for your own financial safety. The decision that saved him wasn’t complex or expensive. It was a simple, proactive step that you can take today.

Here was the plan Sarah at Neill Insurance laid out for Michael, which ultimately shielded his assets:

1. Acknowledge the True Risk: I-35 is not just another highway. With some of the highest traffic volumes and accident rates in the nation, including a staggering 27.9 fatal accidents per 100 miles on I-35E, the risk of a multi-vehicle incident is exponentially higher than on a typical road.

2.Calculate Your Asset Exposure: Your home, savings, and future income are all on the line in a major lawsuit. A minimum policy doesn’t protect them; it only satisfies a legal checkbox.

3.Invest in Meaningful Coverage: For an additional investment of around $400-$600 per year—often just over a dollar a day—you can increase your liability limits to a level that provides real protection. Michael’s 250/500/100 policy provided:

•$250,000 per person for bodily injury

•$500,000 per accident for bodily injury

•$100,000 for property damage

This single decision provided $600,000 in total liability protection, fully covering the $571,000 in damages and preventing a lifetime of financial hardship.

From Risk to Readiness: Start Your Plan Today

We all hope a day like Michael’s never comes. But hope is not a strategy. If you are one of the thousands of Texans who commute on I-35 or other major highways, your financial future is riding on the quality of your insurance policy.

Are you prepared for a worst-case scenario?

Don’t wait to find out after it’s too late. Take the first step toward securing your financial future today.