Your calls go unanswered. Your premium jumped. Your COI got rejected.

If any of this sounds familiar, you’re not alone, and you’re not stuck.

Most electrical contractors we speak with at Neill Insurance don’t realize just how much a complacent agent relationship is costing them. Often it’s not until a delayed COI or denied claim hits that they take a closer look.

Sticking with the wrong agent or an outdated policy is one of the most costly mistakes growing contractors make. It feels easier to stay put, but that comfort can quietly eat away at your profits, your coverage, and your competitive edge.

This guide gives you a 10-point checklist to assess whether it’s time to switch, and explains how to do it without any gaps or drama.

Why Most Contractors Stay with the Wrong Insurance Too Long

Shopping for insurance feels like a hassle when you’re running jobs, managing crews, and staying compliant. That’s why most contractors stick with what they’ve got, even when it’s not working.

They fear:

- Losing coverage during the switch

- Getting buried in paperwork

- Upsetting a long-time agent

But while you’re staying loyal, your business could be:

- Overpaying by thousands

- Carrying risky exclusions

- Falling short of stricter GC requirements

Your policy may not reflect how much your business has grown, and your agent may not even notice.

The Hidden Cost of Staying Put

A bad agent relationship isn’t just about slow service. The real cost shows up in lost jobs, denied claims, and money left on the table.

| Hidden Cost | What It Looks Like |

|---|---|

| Overpayment | Paying $1,500 to $3,500 more per year than contractors with similar coverage. Without competitive quotes, you’re likely overspending. |

| Claim Denial Risk | Your policy hasn’t been reviewed in years. You’re exposed to outdated endorsements and exclusions. |

| Lost Job Opportunities | Your COI is late or non-compliant, so you’re disqualified from high-value bids. |

| Slow Support & Downtime | You’re waiting days for answers on time-sensitive jobs or endorsements. |

| Lack of Strategic Guidance | No one’s helping you prep for bigger projects, growing payroll, or coverage changes. |

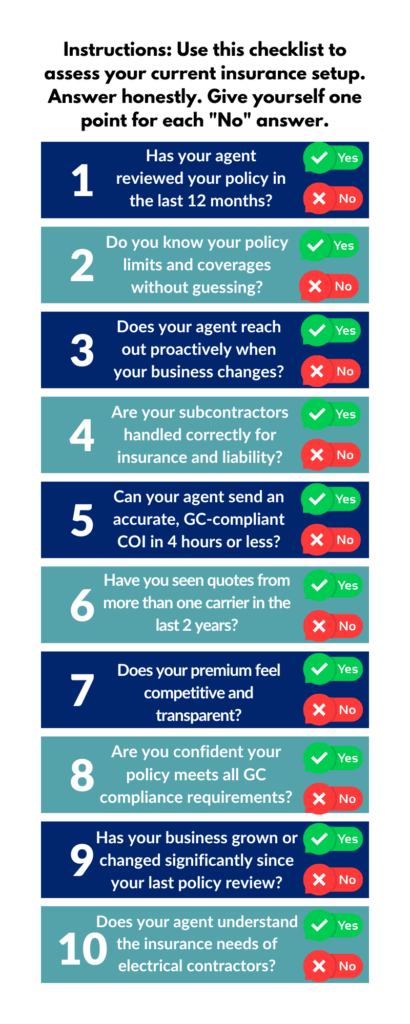

The 10-Point Contractor Insurance Self-Assessment

How to Score Your Results

Tally your “No” answers. Then check your score.

| Score | Diagnosis | Next Step |

|---|---|---|

| 0–2 | You’re in Good Shape | Keep conducting annual reviews and monitoring your agent’s responsiveness. |

| 3–5 | It’s Time to Investigate | You’re likely overpaying or exposed. Get a second opinion and comparison quote. |

| 6–10 | SWITCH IMMEDIATELY | You’re at serious risk. Move now to avoid job loss or claim denial. |

How to Switch Insurance Without the Risk

Contractors often fear that switching mid-policy could leave them unprotected. But a professional agent will handle this seamlessly. The key is timing and coordination.

Here’s how it works:

- Policy Review

A specialist analyzes your current coverage, class codes, exclusions, and endorsements. - Market Shopping

Your profile is shopped to 20 or more construction-specialist carriers for better rates and terms. - Policy Alignment

Your new policy starts before the old one ends, zero lapse in protection. - Instant COIs

Once bound, your agent issues GC-compliant COIs fast and preloads your GC list for future jobs.

FAQs About Switching Contractor Insurance

Will I lose coverage if I switch mid-policy?

No. A professional agent ensures the new policy is active before the old one ends.

Can I keep my policy but get a new agent?

Yes, in some cases. That’s called an Agent of Record (AOR) change. If allowed by your carrier, this gives a better agent control of your current policy.

Will I have to redo all my paperwork?

Not at all. A contractor-specialist agent will handle carrier forms, create updated COIs, and keep your admin time minimal.

How long does it take?

Many contractors are quoted, bound, and switched within 24 to 48 hours.

Make the Right Move for Your Business

You now have the tools to evaluate your coverage and your agent with confidence. If something feels off, it probably is. Don’t wait for a denied claim or lost bid to make the switch.

At Neill Insurance, we help electrical contractors across Texas get faster service, better protection, and real savings, without the risk of a gap.

Request a free policy review and quote comparison. No pressure, no obligation, just clarity.