The Contractor’s Guide to Bid, Performance, and Payment Bonds

Ever wonder what surety bonds really do, and whether you’re using them to grow or just to check a box? Are you confident your bonding strategy protects your business, or could it be quietly holding you back from bigger jobs and better clients?

Surety bonds are one of the most misunderstood tools in construction. But when used strategically, they unlock larger projects, reduce financial risk, and build instant trust with clients. Whether you’re bidding on public work for the first time or trying to expand your bonding capacity, this guide is built to help.

In this article, you’ll learn:

- What surety bonds actually are and how they work

- The difference between bid, performance, and payment bonds

- How bonds are priced and what qualifies you for them

- How to increase your bonding capacity to win larger projects

- What public works laws like the Miller Act mean for you

Let’s break it all down.

What is a Surety Bond?

The Three Parties That Make It Work

Unlike traditional insurance, a surety bond is a three-party agreement that guarantees your performance and payment on a job. Here’s who’s involved:

- The Principal: That’s you, the contractor, responsible for fulfilling the contract

- The Obligee: The project owner, often a government agency, requiring the bond

- The Surety: The company backing the bond and promising the obligee you’ll follow through

Think of it as a financial promise. If you can’t finish the job or pay your subcontractors, the surety steps in to make things right, and then collects from you.

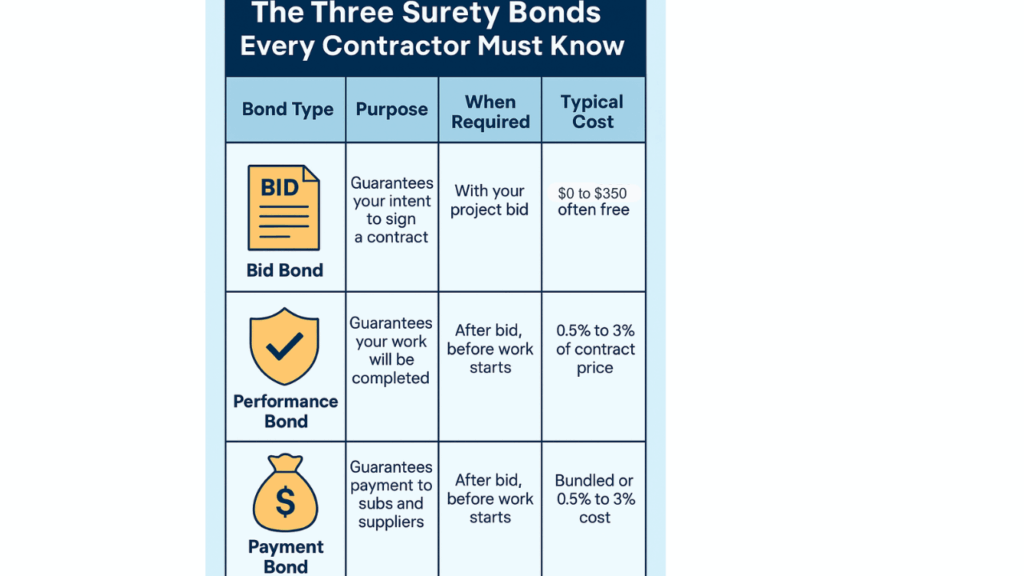

The Three Surety Bonds Every Contractor Must Know

1. Bid Bonds: Your Promise to Commit

Bid bonds protect project owners during the bidding phase. They ensure you’ll enter a contract and provide performance and payment bonds if selected.

How it works: If you win a bid but walk away, the surety pays the difference between your bid and the next lowest one, up to the bond’s full amount.

Cost: Often free for qualified contractors, or under $350 per bid

2. Performance Bonds: Your Work Guarantee

Performance bonds protect the project owner from financial loss if you default or fail to complete the work as agreed.

How it works: If you fall short, the surety will either fund a replacement contractor or step in directly to finish the job.

Cost: Usually 0.5% to 3% of the total contract value

3. Payment Bonds: Your Supplier Protection

Payment bonds ensure you pay subcontractors, laborers, and suppliers. This prevents liens and gives the project owner peace of mind.

How it works: If you don’t pay, they can claim the bond to recover payment.

Cost: Often bundled with the performance bond, pricing is similar

The “Three C’s” of Surety Bond Underwriting

Surety bonding is like applying for a loan. Underwriters want to know you can deliver on your promises, and they judge this through the Three C’s:

Character

Your reputation, business ethics, and financial reliability

Tip: Clean credit, timely vendor payments, and a history of job completion all matter here

Capacity

Your ability to perform the job

Tip: The surety will review your equipment, team, and experience with similar projects

Capital

Your financial strength and stability

Tip: Strong working capital, profitability, and CPA-reviewed financials boost your case

What Is Bonding Capacity, and How Do You Increase It?

Your bonding capacity is the total amount of bonded work your surety will allow you to take on at once. It directly affects how large your jobs can be and how fast your company can grow.

To expand it, here’s what we recommend:

- Tighten Financial Management: Retain earnings, manage cash flow well, and work with a construction CPA

- Build a Winning Track Record: Document completed jobs and share them with your surety

- Increase Gradually: Move from $100k to $300k jobs before aiming for $1M

- Diversify Projects: Balance public and private jobs across various scopes

- Stay Bond-Ready: Keep your surety partner updated on your business goals and finances

Public Project Bonds: What the Miller and Little Miller Acts Require

Public jobs come with legal bonding requirements:

- Federal Projects: The Miller Act mandates performance and payment bonds on any federal job over $150,000

- State and Local: Little Miller Acts vary by state. In Texas, public works projects over $25,000 require bonds

These laws protect taxpayers and ensure subcontractors get paid, even if the General Contractor defaults.

Secure the Bonds That Build Bigger Opportunities

Surety bonds are not just red tape. They are tools that help you grow, win better jobs, and build lasting trust with project owners. When you understand how they work and how to qualify, they become a strategic advantage, not just a requirement. Now that you know the roles of bid, performance, and payment bonds, plus how to qualify and grow your capacity, you’re one step closer to the kind of jobs that elevate your business.

At Neill Insurance, we specialize in construction bonding. We know how to help contractors grow their bonding capacity, qualify for larger projects, and protect their reputation with rock-solid compliance. We’ve helped contractors across Texas take control of their bonding, and their growth. Let’s do the same for you. Let’s review your current bonding situation and show you how to grow.