Are insurance requirements getting in the way of winning jobs in Dallas?

Do you feel like your coverage hasn’t kept pace with your growing construction business?

You’re not alone. With the 2026 construction surge continuing across North Texas, Dallas contractors face tighter insurance expectations, more risk on the job site, and higher stakes when something goes wrong.

If you’ve been in business for 3+ years and are generating $1 million or more in revenue, your insurance isn’t just a requirement, it’s a competitive advantage. This guide will walk you through the exact coverages Dallas contractors need, how much they typically cost, and proven ways to lower premiums without cutting protection.

The “Big Three” Policies Every Dallas Contractor Needs

1. General Liability (GL): Your First Line of Defense

GL insurance protects your business against third-party claims of bodily injury or property damage. In a high-risk litigation environment like Dallas, state minimums are not enough.

What to Carry in 2026: $1M per occurrence and $2M aggregate is the new baseline, but contractors with over $1M in revenue should consider $2M/$4M or a Commercial Umbrella policy.

Dallas-Specific Tip: Watch for the “Action Over” exclusion. Many cheaper GL policies exclude lawsuits where an injured subcontractor sues the property owner, and the owner sues you. This is common in Texas and can leave you exposed.

2. Workers’ Compensation: A Must-Have for Growth

Texas is one of the few states where Workers’ Comp is optional, but not for long if you want to grow.

Why You Need It:

- Most commercial projects in Dallas require it to bid.

- It provides liability protection by limiting lawsuits from injured workers who accept benefits.

- Going without it (as a non-subscriber) exposes you to unlimited legal claims.

3. Commercial Auto: Business Use = Business Policy

Personal auto insurance will not cover business use. If your vehicles are titled to your business, you need Commercial Auto coverage.

Recommendation: Carry at least a $1M Combined Single Limit (CSL) to cover both bodily injury and property damage in one accident. Dallas traffic on I-35, I-75, and the Tollway makes accidents all but inevitable.

Insurance for Contractors Over $1M in Revenue

Once your business surpasses $1 million in revenue, you’re exposed to more risk. These coverages help protect your larger operation and assets.

Commercial Umbrella / Excess Liability

This extends your liability protection beyond your primary GL, Auto, or Workers’ Comp policies. A serious accident can easily exceed standard policy limits.

Cost: Often less than $1,000/year for a $1M Umbrella. It’s the cheapest “sleep insurance” available.

Inland Marine (Tools & Equipment)

Covers mobile tools, trailers, and equipment wherever they are—on-site, in transit, or in storage. General Liability does not cover theft or damage to your own tools.

Tip: Add “Leased or Rented Equipment” if you rent heavy machinery.

Completed Operations Coverage

Liability doesn’t end at project handoff. You can be sued years later if the work fails.

Texas Statute: You can be held liable for construction defects up to 10 years after completion. Make sure your GL policy includes full Products-Completed Operations coverage.

What Insurance Costs in Dallas (2026 Estimates)

For a typical Dallas contractor with $1M revenue, 5 employees, and 3 trucks:

| Coverage Type | Estimated Annual Cost |

|---|---|

| General Liability | $3,500 – $6,500 |

| Workers’ Comp | $4,000 – $12,000 (trade-specific) |

| Commercial Auto (3 trucks) | $6,000 – $9,000 |

| Umbrella ($1M limit) | $700 – $1,500 |

| Inland Marine ($50K tools) | $500 – $1,000 |

Frequently Asked Questions

Do I need Workers’ Comp in Texas if it’s not required by law?

If you want to work on larger commercial jobs in Dallas, yes. Most GCs and clients require it regardless of state law.

What is an Action Over exclusion, and why does it matter?

It removes coverage if a subcontractor’s employee sues the property owner, and they sue you. It’s a major gap for contractors in Texas.

Can I use personal auto insurance for work trucks?

No. Personal auto policies exclude business use, and claims could be denied.

What does Inland Marine insurance cover?

It covers mobile tools, trailers, and equipment from theft, vandalism, or loss anywhere they go.

Do I need Completed Operations coverage?

Yes. In Texas, you can be sued for defects up to 10 years after a job is finished. This coverage protects you long after project closeout.

Insurance That Wins Bids and Protects Growth

As a Dallas contractor in 2026, you’re not just managing job sites, you’re managing risk. The right insurance coverage can help you win better jobs, meet contract requirements, and avoid financial disaster.

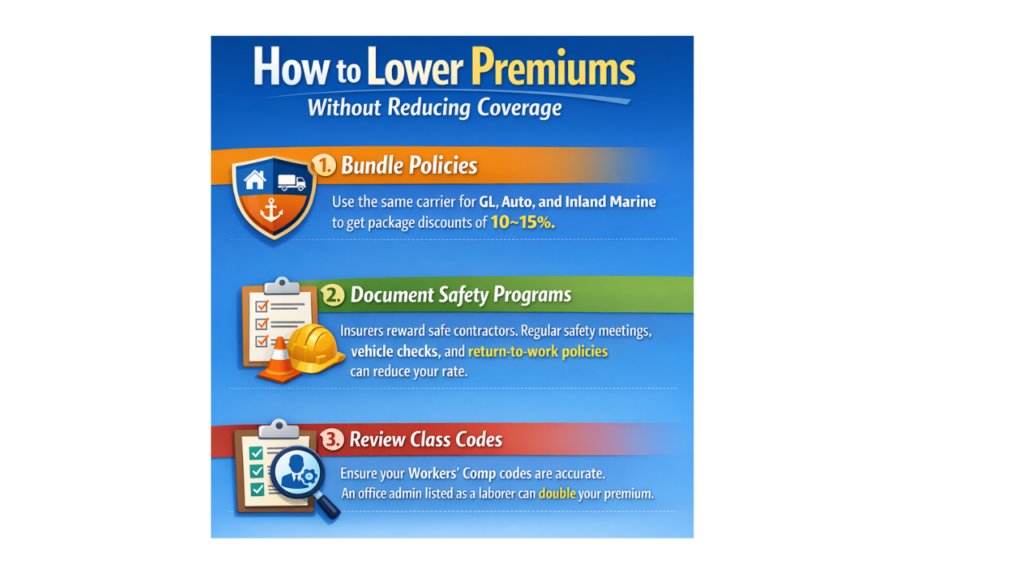

Now that you understand the must-have policies, typical costs, and cost-saving tactics, your next step is simple: review your coverage with a partner who understands the local market.

Schedule a free policy review with Neill Insurance Brokers today. We’ll help you lower risk, cut costs, and protect what you’re building.