You’ve made personal resolutions for the new year, but have you made one that protects your business?

It’s 2026. Everyone is chasing their “new year, new me” goals, maybe hitting the gym, spending more time with family, or finally cleaning out the garage.

But what about your business?

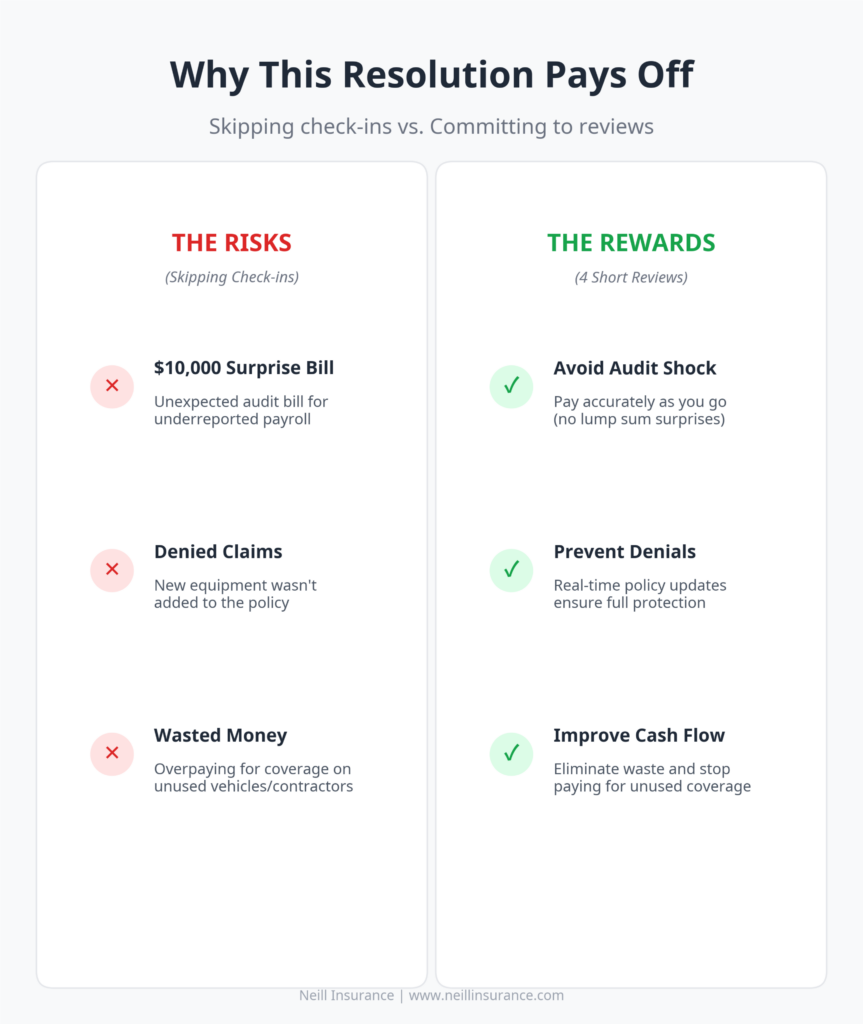

If you’re like most contractors, insurance falls into the “set it and forget it” category. You renew your policy in January, file it away, and move on, until a claim hits or you get slapped with a surprise audit bill.

Here’s the truth: that hands-off approach is the number one reason contractors overpay or get stuck with denied claims.

Your business evolves all year. If your insurance stays static while your operation grows, you are creating financial blind spots.

This year, we challenge you to make one simple resolution that could save you thousands, and takes just one hour total all year.

The One Resolution That Matters: The Quarterly Check-In

Commit to a 15-minute insurance review once a quarter.

That’s it. Four short calls or check-ins over the course of 2026 to make sure your coverage still matches your business.

At Neill Insurance, we’ve seen that the most successful contractors in Frisco aren’t just good at building things, they’re great at protecting what they’ve built. They don’t treat insurance like a bill. They treat it like a business tool.

Here’s how to make that resolution happen, step by step.

Q1 (January – March): The New Year Launch

Focus: New projects, new hires, new equipment

This is when most contractors set the tone for the year. Maybe you closed a big commercial contract in Plano or Frisco. Maybe you bought a new diesel truck in December to reduce taxes.

Your Q1 Insurance Check:

- Equipment: Send your bill of sale so that new gear is protected on day one.

- Payroll: Made new hires or gave raises? Let’s update your Workers’ Comp estimate now to avoid audit surprises later.

- Contracts: Review insurance requirements for recent wins. Are you compliant?

Q2 (April – June): The Summer Ramp-Up

Focus: Seasonal hiring, fleet expansion, revenue forecasting

As the summer heat sets in, your workload and risk exposure often rise too. This is a big quarter for taking on more labor and equipment.

Your Q2 Insurance Check:

- Temp Labor: Are your 1099s and W-2s classified properly? Missteps here trigger audits.

- Revenue: If you’re trending above projections, let’s update your General Liability rating to spread costs out.

- Rentals: Renting equipment? Make sure your policy covers it so you don’t pay those steep rental damage waivers.

Q3 (July – September): The Pre-Renewal Prep

Focus: Claims review and market strategy

Halfway through the year is the perfect time to assess performance, and shop early if needed.

Your Q3 Insurance Check:

- Claims: Have you had any small fender benders or jobsite issues? Let’s get ahead of how they’re being coded.

- Market Check: If your rates are creeping up, we can start exploring better options now, not a week before renewal.

Q4 (October – December): The Finish Line

Focus: Tax planning and cleanup before year-end

Smart contractors use Q4 to make tax-savvy insurance decisions and close out open items.

Your Q4 Insurance Check:

- Tax Planning: Prepay your 2027 premium now to lock in deductions for this year.

- Audit Prep: We help you collect missing subcontractor COIs early, not during audit chaos.

- Fleet Review: Selling older trucks? Remove them from your policy right away to stop paying premiums on vehicles you no longer own.

Frequently Asked Questions (FAQ)

What is a Quarterly Insurance Check-In?

It’s a short, scheduled conversation every 3 months to review changes in your business and adjust your insurance accordingly.

What if I don’t do quarterly check-ins?

You risk audit surprises, uncovered claims, and paying for coverage you no longer need.

Does this take a lot of time?

No. Each check-in takes about 15 minutes. We handle the prep and walk you through it.

Can I start this mid-year?

Yes. Whether it’s January or July, it’s never too late to take control of your coverage.

Protect Your Business in 2026, Without the Headaches

Your construction business is growing. Your insurance should grow with it.

This one resolution, the Quarterly Check-In, takes just an hour a year, but it can prevent thousands in unnecessary costs and delays.

At Neill Insurance Brokers, we don’t just write policies. We build relationships that grow with you. We ask the questions others miss. We protect what you’ve worked hard to build.

Call us today at (682) 237-7975 or visit our office at 101 N Oak St in Roanoke.

Let’s get your 2026 insurance strategy working as hard as you do.